Lender of The us Securities analyst Wamsi Mohan has downgraded Apple’s inventory to a “neutral,” citing a new stability to threat and reward as the inventory has strike new highs next a blockbuster earnings report.

After hiking a concentrate on value for Apple inventory to $420 following the earnings report, Wamsi Mohan at Lender of The us Securities has all over again revised his expectations for the inventory. In a observe to investors observed by AppleInsider, Mohan is now no longer underwater at $470 for each share, but has reclassified the inventory as neutral compared to get, due to the fact he sees the stock as far more balanced than it has been beforehand.

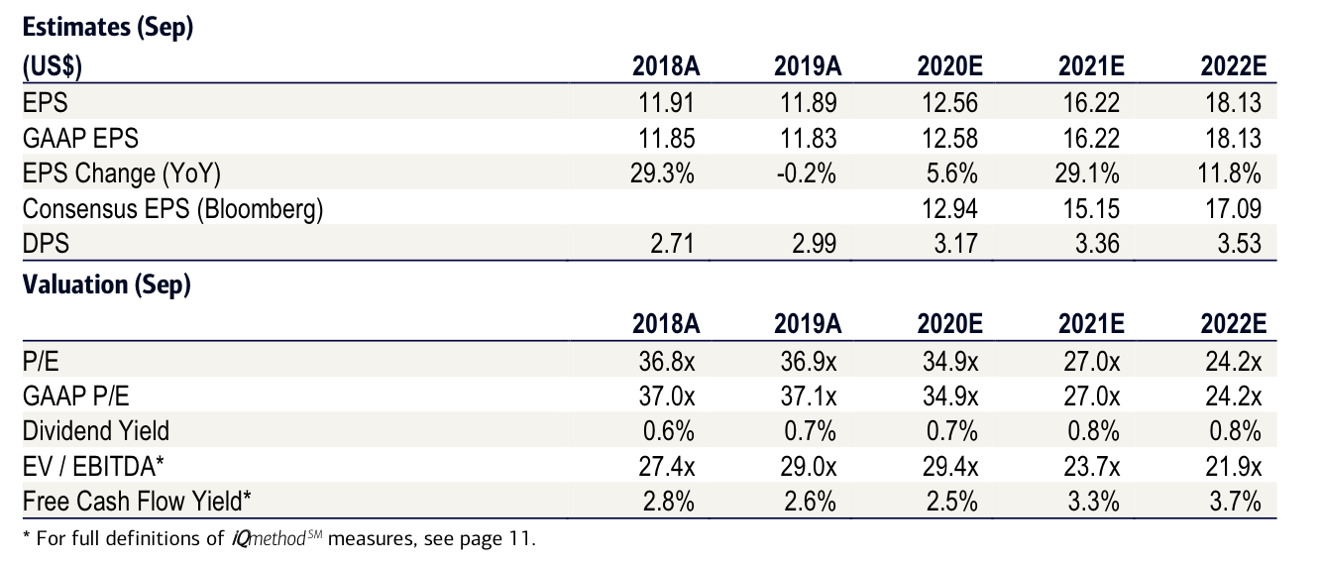

Mohan’s new $470 Apple inventory cost goal assumes solitary-digit yr over calendar year income grown, and flat margins from hardware for the fall, including the “Iphone 12.” Like other analysts, Mohan believes that there will be “significant-teens” year above 12 months advancement in providers, and an boost in providers margins.

To aid a $17 earnings for every share, Mohan thinks that $6 of that will occur from Solutions with a 40x earnings for each share numerous, with the remaining $11 getting shipped from components at a 20x earnings for every share.

Mohan justifies the a number of on Apple’s huge income harmony and “prospect to diversify into new stop markets, increasing blend and diversity of companies.”

Bank of The usa 2021 and 2022 estimates for Apple

Overall positives for Apple, in accordance to Mohan are Apple’s hardware solution cycle getting to be a lot less materials as a % of complete earnings over time, the firm’s faithful person foundation, a increasing put in foundation, and small Companies penetration. Probable negatives, top to the “neutral” score are the reality that valuation has moved to the better finish, a possibility to margins and Providers growth for calendar yr 2021, buyback influence to the inventory rate is muted, and the growth in the latest final results being cyclical rather than “secular.”

On the upside, Mohan sees achievable avenues for further more progress. Particularly, Mohan suggests that there could be “a much better than predicted cycle from 5G iPhones, gross margin upside, fund supervisors closing the underweight gap and a weak greenback” that could contribute to an incremental upside.

Notably, Mohan extensively skipped estimates for Apple’s 3rd quarter. Mohan predicted $51.7 billion in earnings, with a $1.89 earnings per share, vs . Apple’s real earnings of $59.7 billion and an earnings for every share of $2.58.